.

Edelman Smithfield presents the findings of its 2025 Global LP Survey on Private Capital

Our survey of 400 global LPs reveals how leadership visibility, brand perception, and strategic communications directly influence capital allocation decisions in private markets.

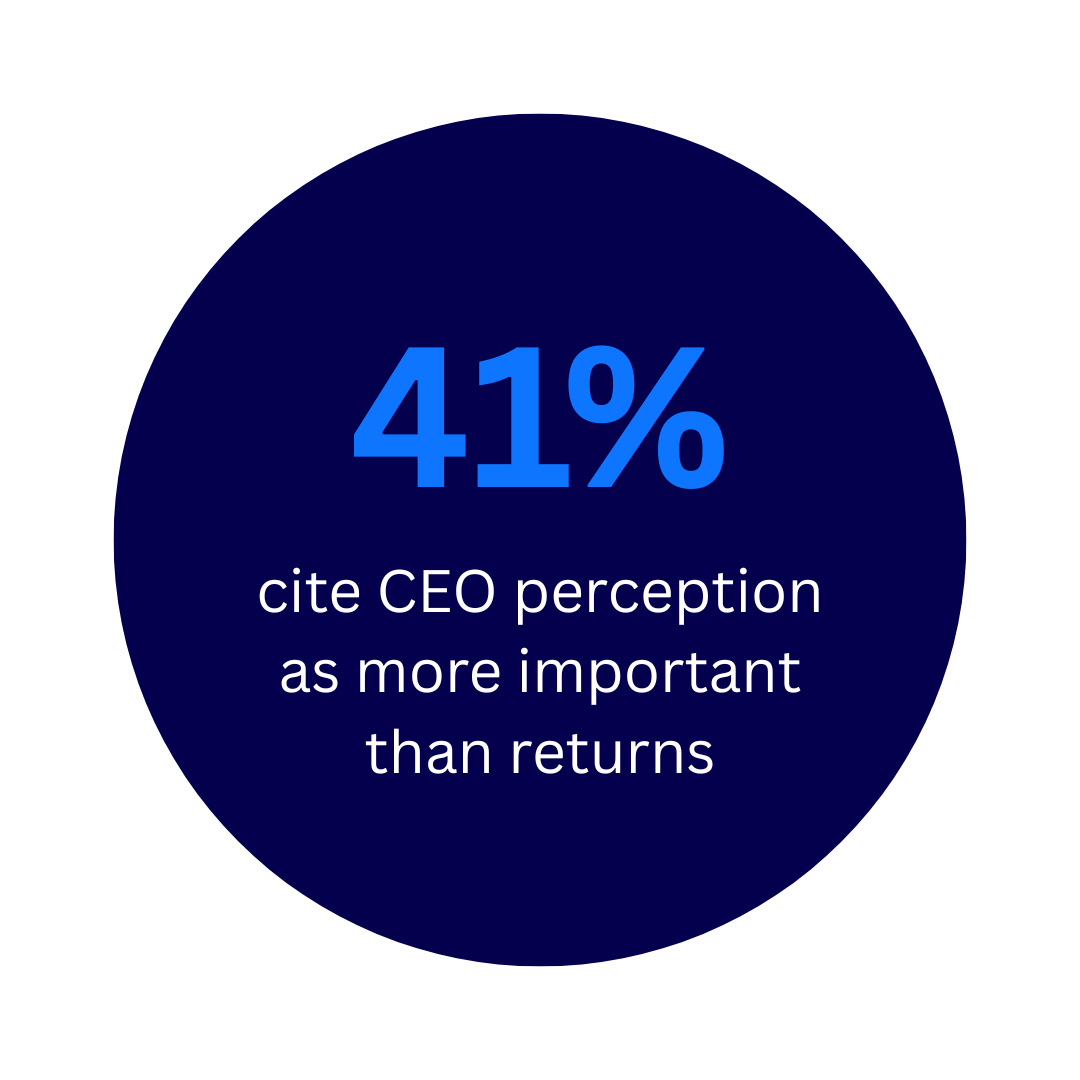

GP Leadership Visibility Matters

Public profile has a major influence on LP perception

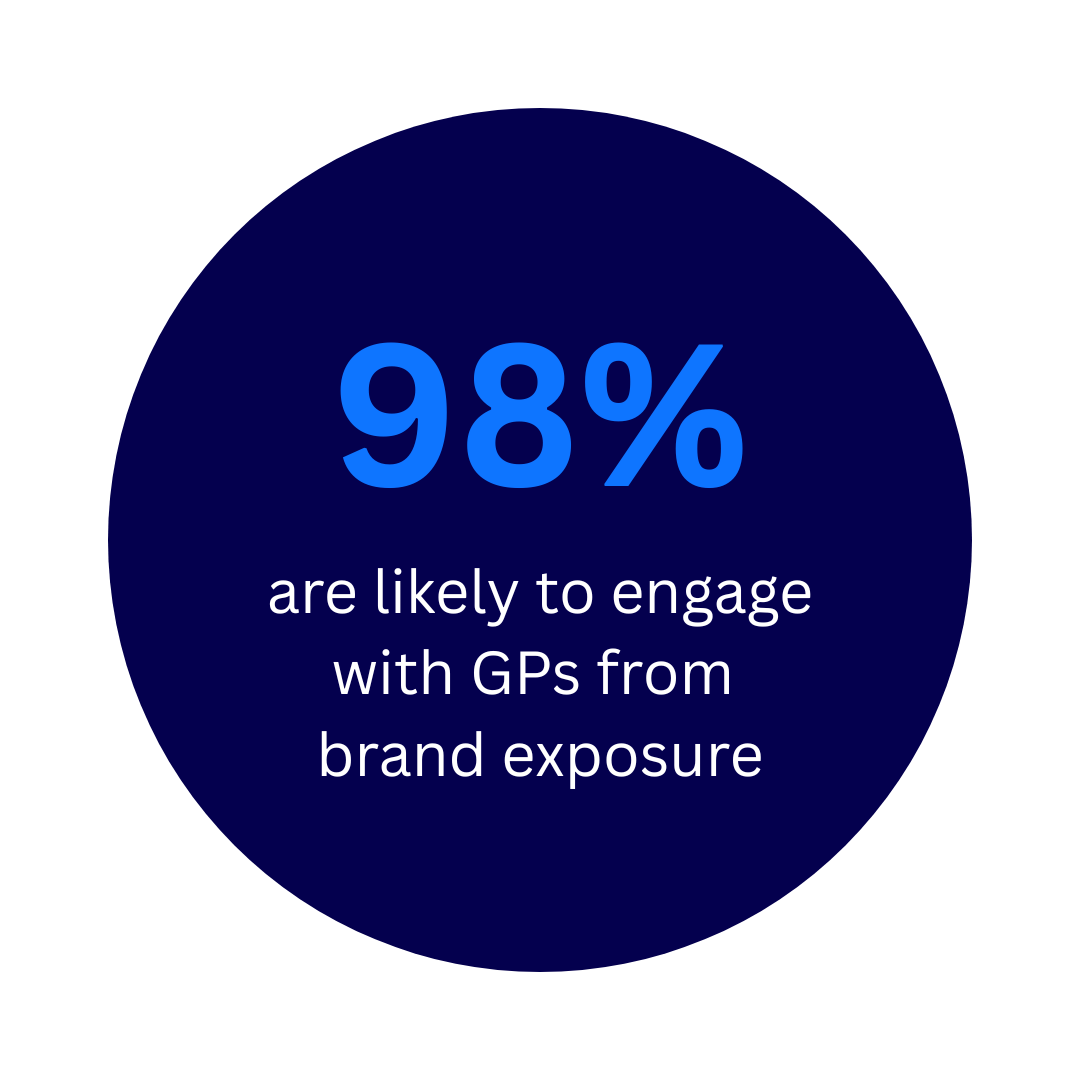

Publicity Prompts Action

LPs regularly find new GPs through public channels

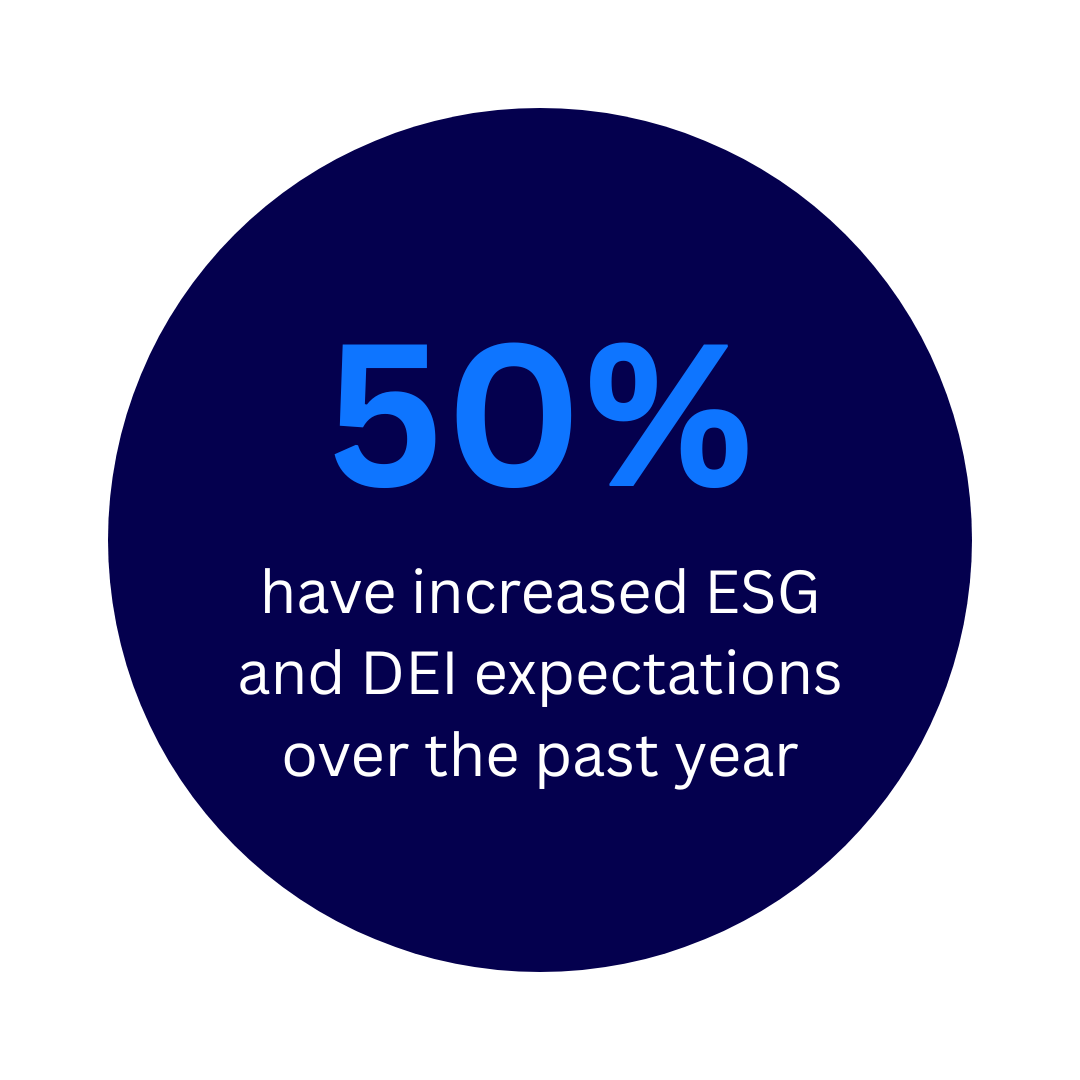

ESG Progress Remains a Priority

But LPs prefer integrated updates over standalone reporting

How Edelman Smitheld Supports Private Capital Firms

We help GPs differentiate, drive visibility and build trust through integrated communications strategies.

Discover what Drives LP Trust

Sign up below to receive the report

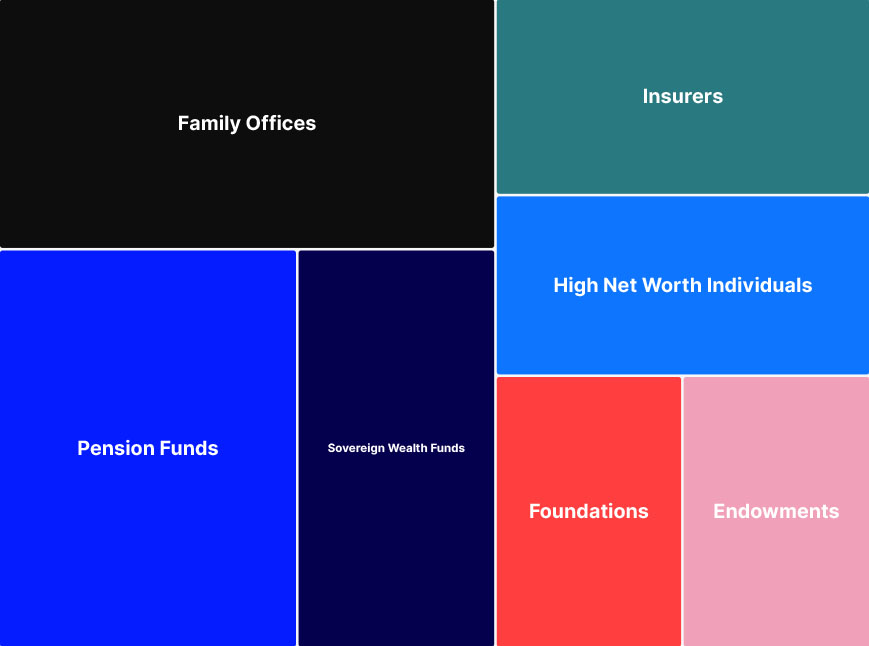

Survey Methodology

The 2025 Global LP Survey was conducted with 400 institutional investors equally distributed across North America, Europe, APAC, and the Middle East. Respondents represent the full spectrum of LP types, including family offices, pension funds, sovereign wealth funds, insurers, high-net-worth individuals, foundations, and endowments. The sample covers organizations with assets under management ranging from $1 billion to $200+ billion, with 67% managing over $50 billion. Most respondents invest across multiple private capital strategies, including private equity (74%), private debt (65%), infrastructure (34%), and natural resources (12%).

.